The year-end closing process in accounting is the time when companies do an audit and update their books at the end of the financial year. This is a very important step in every business’s financial reporting process, as it lays the foundation for next year’s financial and strategic planning. It’s important to work with the finance team to pull flux analysis forward into variance analysis accounting for subscriptions revenue journal entry for all P&L and balance sheet accounts. Update the team on year-to-date spend reports and provide a strategic narrative around the prior month’s performance. Every accounting team should have a documented month-end close checklist to follow month in and month out. This is one of the most repetitive processes you’ll go through — but you can’t get complacent and let the small details slip.

Cash Flow Forecast Template

All sample texts from the checklists are 100% editable and downloadable in Microsoft Word. With the sample texts, you can quickly create the content for your accounting checklist within minutes. When you use our monthly bookkeeping checklist, you provide your team with everything they need to complete tasks without you. A monthly bookkeeping checklist template will help you create a standardized, efficient, and quick workflow process to complete monthly bookkeeping for your clients. With our accounting checklist, we ensure you have a smooth process in performing an internal audit. An internal audit is a critical activity a company should do to check components that allows your business to be functional, including the cash flow.

reasons why standardizing your processes is a win for your clients

The beginning of the month is a good time to send out overdue reminder statements to customers, clients and anyone else who owes you money. Track your accounts payable and have funds earmarked to pay your suppliers on time to avoid any late fees and maintain favorable relationships with them. If you are able to extend payment dates to net 60 or net 90, all the better. Whether you make payments online or drop a check in the mail, keep copies of invoices sent and received using our accounting software. Keep copies of all invoices sent, all cash receipts (cash, check and credit card deposits) and all cash payments (cash, check, credit card statements, etc.). Record each transaction (billing customers, receiving cash from customers, paying vendors, etc.) in the proper account daily or weekly, depending on volume.

- All of these accounting checklists are designed to be empowered by automation.

- Just as you reconcile your personal checking account, you need to know that your cash business transaction entries are accurate each month and that you are working with the correct cash position.

- Our checklists enable anyone to perform accounting activities, and as you go through you’ll see the different steps explained where necessary.

- Take the necessary steps to ensure you’re adhering to the new guidelines in ASC 606 for revenue recognition.

- And when you stay on top of issues, you’ll be able to complete the reviews in a timely fashion, establishing your firm as dependable, consistent, and trustworthy.

Own the of your business.

This profit and loss dashboard template provides a visual overview of financial data, including total business income, cost of goods sold, gross profit, earnings before interest and taxes, and net revenue. Get a snapshot of your monthly profit and loss report by entering your financial data and selecting the month that you want to view in the dashboard. This template includes a ledger for tracking customer payments and an accounts receivable aging tab to track outstanding payments. The template automatically populates the accounts receivable aging sheet after you fill in the payment ledger.

Best accounting software for completing daily, weekly and annual accounting tasks

You can change its fonts, layout, and colors according to your desired output. And once done, you can save and download a soft copy either for printing or for sharing online. As CEO and Co-Founder, Mike leads FloQast’s corporate vision, strategy and execution. Prior to founding FloQast, he managed the accounting opportunity costs and the production possibilities curve team at Cornerstone OnDemand, a SaaS company in Los Angeles. Besides that, you can also edit the content on Template.net’s editor platform. The user-friendly platform and text tools make it easier for anyone to apply their process, import company logos and brand names into your accounting checklists.

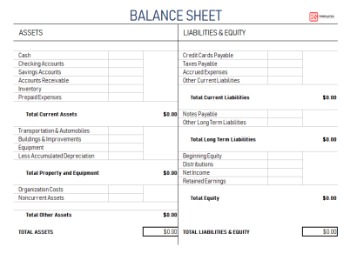

This is a best practice process for monthly accounting, including monthly bookkeeping essentials and month-end close processes. In addition to the previous step, you must conduct a month-over-month review of the balance sheet. This process allows you to confirm the balances in the balance sheet line items, which are the assets and liabilities plus the owner’s equity accounts. The goal is to ensure payments to all employees are correct, including bonuses, commissions, and other benefits.

The statement provides a summary of the company’s revenue and expenses, along with the net income. Use this income statement template to create a single-step statement that groups all revenue and expenses, and is helpful for businesses of all sizes. Every accounting team manages a set of tasks to be completed to ensure that the organization’s books are closed on time with no errors or omissions. In larger organizations, these tasks often involve multiple individuals across different departments and geographies.

This template helps maintain accurate records of clients’ monthly financial transactions, expenses, and income. The profit and loss account summarizes the company’s income and expense transactions for the period. Its bottom line, the net kennedy introduces bill expanding louisiana disaster victims income, indicates the company’s profits after all expenses, including loan interests and tax payments. In short, it reflects the cash for products or services you sold or delivered and have yet to receive payment from your customers.

If you don’t have any process automation set up in your business yet, no need to worry. A lot of accounting work is knowing what the necessary process is and being able to follow it effectively. The processes we have listed here range from onboarding accounting staff to invoicing clients, to bank reconciliation and end of year reporting. Review the payroll summary before payments are disbursed to avoid having to make corrections during the next payroll period.

After all, if your team doesn’t have a good monthly bookkeeping process, then you are probably struggling with quarterly reports, year-end reviews, and other critical bookkeeping tasks. This accounting client onboarding checklist template will help to ensure that every step of your client onboarding is covered consistently and efficiently. Here is a list of common accounting templates, designed to save you time, streamline your days, reduce manual inputs, and drive more client value.